Create a Function in C++ for Calculating the Tax Due that usesthe

2018 Tax Table Worksheet.

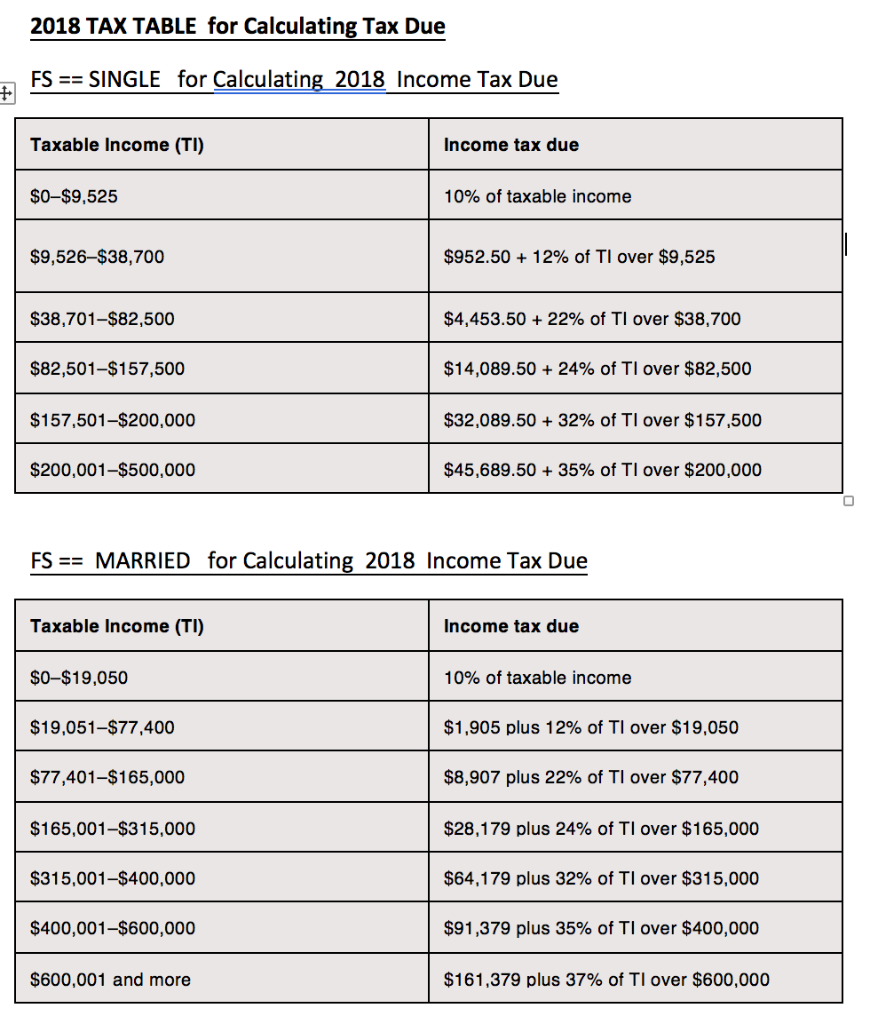

[see 2018 TAX TABLE for Calculating Tax Due]

2018 TAX TABLE for Calculating Tax Due FS == SINGLE for Calculating 2018 Income Tax Due Taxable Income (TI) Income tax due $O-$9,525 10% of taxable income $9,526-$38,700 $952.50 + 12% of TI over $9,525 $4,453.50 + 22% of TI over $38,700 $14,089.50 + 24% of TI over $82,500 $32,089.50 + 32% of

OR

OR